Swayam Academy

Helping You To Trade Smartly

Swayam Academy , 403-C , Fourth Floor , Richmond Plaza

Richmond Circle , Opp To Employee Provident Fund Office

Bengaluru, Karnataka 560 028

India

ph: 08041212385

feedback

- Home

- Training Pictures

- Training Programs Offered By Us

- Organisation Introduction

- Technical Analysis

- W D Gann Angle Theory

- Gann Price Vs Time Squaring - Finding Support & Resistance

- Gann Squaring High & Low - Predicting Future High & Low Dates

- Gann Dates & Market Moment

- Gann Swing Analysis

- Gann Astrononamy

- Gann Astrononamy - Zodiac & Houses

- Gann Astrononamy - Planetary Aspect & Market Outcome

- Gann Astrononamy - Individual Birth Chart & Trading

- Gann Astrononamy - Companies Birth Chart & Trading

- Gann Astrononanmy - Trading On Index Based On Planetary Positions

- Fibonacci

- Elliot Wave Theory

- Dow Theory

- The Charts

- Japanese Candlestick Pattern

- Single Candlestick Patterns

- Bearish Double-Stick Candle Patterns

- Bearish Three-Stick Candle Pattern

- Bullish Double-Stick Candle Patterns

- Bullish Three-Stick Candle Pattern

- Fundamental Analysis

- Trading Tools & Software

- NCFM Courses

- Contact Us

W D Gann Angle Theory

W D Gann Technical Analysis Wizard

In developing his theories, Gann was undoubtedly one of the most industrious technical analysts. He made thousands of charts displaying daily, weekly, monthly, and yearly prices for a wide variety of stocks and commodities. He was a avid researcher, occasionally charting a price back hundreds of years. At a time when most market analysis was strictly fundamental, Gann’s revolutionary theories relied on natural laws of mathematics, time cycles, and his unshakable conviction that past market activity predicted future activity .

W D Gann's Law Of Vibration

Gann in his Stock Market Courses have explicitly proved that all stocks and commodities vibrate. He named it as " W D Gann's Law Of Vibration " in that he says that if we can calculate the rate of vibration then its is possible to predict the future price moment of the asset. The principle of Gann Angle Theory is based on this concept only.

Gann Price Vs Time Square & Gann Angle

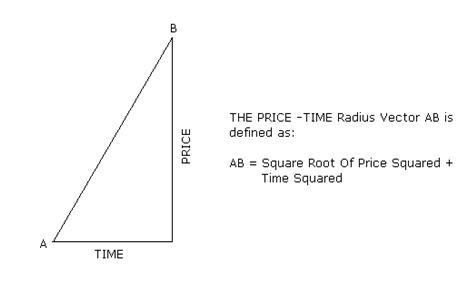

The squaring of price and time was one of the most important and valuable discoveries that Gann ever made. In his trading course he stated “ if you stick strictly to the rule, and always watch when price is squared by time, or when time and price come together, you will be able to forecast the important changes in trend with greater accuracy”.

The squaring of price with time means an equal number of points up or down, balancing an equal number of time periods- either days, weeks, or months. Gann suggested traders square the range, low prices, and high prices.

The squaring of price with time means an equal number of points up or down, balancing an equal number of time periods- either days, weeks, or months. Gann suggested traders square the range, low prices, and high prices.

Gann has plotted the relationship between price and time. He explicitly stated that at the point of intersection between the price and time trend line there is a valid reason for a expectation of change in trend. Gann has given 11 different trend lines which will guide the trader in taking timely wise decision. These trend lines are drawn based on the geometrical angle proportion in X and Y axis.

The most important trend line 1X1 (read it “one by one” ) Gann angle. This is a straight line drawn in the price-time chart which makes and angle 45° with the X-Axis. i.e. This is the trend line drawn assuming 1 unit of price change with respect to 1 unit of time change in a semi log scale. Similarly 2X1 ( two by one) trend line means line is drawn assuming the 2 unit of price rise or fall happens in 1 unit of time. This trend line makes geometrical angle of 63.75° with X Axis when drawn from a lower price point and projected toward higher price points. Similarly this trend line will make 26.25° with respect respect to X-Axis when it is drawn from a higher price point and projected towards the lower price point.

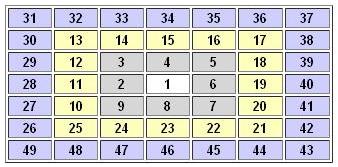

Gann Wheel

Gann was always emphasizing in his training courses that a trader should keep to the rules and watch for when the price is squared by time or when price and time come together and the trader will be able to forecast the major trend changes with unbelievable accuracy, especially when using the Gann wheel or the square of nine as illustrated below.

What Gann says is that we know that the square root of 15 is 3.87 and that we add 2 to the square root of 15 we get the number 5.87. If we square 5.87 we get 34. So if we add 2 to the square root of a number and then squaring that number, it is the same thing as one 360 degree rotation on the Gann wheel. So if 2 represents a 360 degree rotation then 1 must represent a 180 degree rotation and 0.5 is a 90 degree rotation. It’s the 90 degree that Gann claimed was very important in the markets. He was saying that adding and subtracting 0.5 or exact multiples of .5 to the square root of a stock price and then squaring the result is significant. As we know 90 degrees is also very prominent in astrology and maybe Gann was influenced by heavenly events too.

What is unique aspect about the Square of Nine is that it completely unconcerned whether the variables are a range of prices, one particular price, or a number of stock trading days, for example. For the Square of Nine they are identical and totally exchangeable. For a trader who has been brought up on charts, moving averages and oscillators the concept of squares, circles and square roots can be a little daunting and maybe a little mystifying.

We have developed Gann Angle Calculator for calculating support and resistance price of an asset . This will help the trader in taking intraday trading calls. This is a very popular tool used by traders across India .

SQUARER - 2012 SOFTWARE USER GUIDE

Buy & Download

1. SQUARER - 2012 SOFTWARE

= Rs. 2750/-

2. GANN ANGLE THEORY - E-BOOK

= Rs. 799/-

3. AUDIO VISUAL PRESENTATION

CD ON GANN ANGLE THEORY

= Rs. 549/-

SQUARER - 2012 Software

+

Gann Angle Theory & Its Application In Indian Market - E Book

+

Audio Visual Presentation CD On Gann Angle Theory

Special Offer Price

Rs. 3250 /-

For Order & Bank Deatils email us @ feedback@stocktradingfundamentals.comYou

Copyright 2011 Stock Trading Fundamentals. All rights reserved.

Swayam Academy , 403-C , Fourth Floor , Richmond Plaza

Richmond Circle , Opp To Employee Provident Fund Office

Bengaluru, Karnataka 560 028

India

ph: 08041212385

feedback