Swayam Academy

Helping You To Trade Smartly

Swayam Academy , 403-C , Fourth Floor , Richmond Plaza

Richmond Circle , Opp To Employee Provident Fund Office

Bengaluru, Karnataka 560 028

India

ph: 08041212385

feedback

- Home

- Training Pictures

- Training Programs Offered By Us

- Organisation Introduction

- Technical Analysis

- W D Gann Angle Theory

- Gann Price Vs Time Squaring - Finding Support & Resistance

- Gann Squaring High & Low - Predicting Future High & Low Dates

- Gann Dates & Market Moment

- Gann Swing Analysis

- Gann Astrononamy

- Gann Astrononamy - Zodiac & Houses

- Gann Astrononamy - Planetary Aspect & Market Outcome

- Gann Astrononamy - Individual Birth Chart & Trading

- Gann Astrononamy - Companies Birth Chart & Trading

- Gann Astrononanmy - Trading On Index Based On Planetary Positions

- Fibonacci

- Elliot Wave Theory

- Dow Theory

- The Charts

- Japanese Candlestick Pattern

- Single Candlestick Patterns

- Bearish Double-Stick Candle Patterns

- Bearish Three-Stick Candle Pattern

- Bullish Double-Stick Candle Patterns

- Bullish Three-Stick Candle Pattern

- Fundamental Analysis

- Trading Tools & Software

- NCFM Courses

- Contact Us

Why Invest In Share ?

Why Equity's is a must for your portfolio

Researches have proved , time and again , that equities are among the best long term investments in the financial market.

Shares are designed to give two types of return to the investor (a) Annual Return - In form of Dividends. (b) Capital Growth In Long Term.

While investing in any financial instrument its important that we consider whats the Future Value (FVn) of the Present Investment.

Positives Of Shares Market Investment

Shares and simple to understand .

In Shares you can start with a small investment.

Shares of companies with strong fundamentals can provide better long term return.

With Shares you can diversify into various sectors.

Shares can be tax effective.

Shares are liquid.

Negatives Of Share Market Investment

Share prices are volatile there is a matter of risk involved.

Investing in shares of wrong companies can erode your capital.

Equity Vs Other Asset Class Return Comparison For Last 30 Years

FAQ : Income TAX & Equity Investment

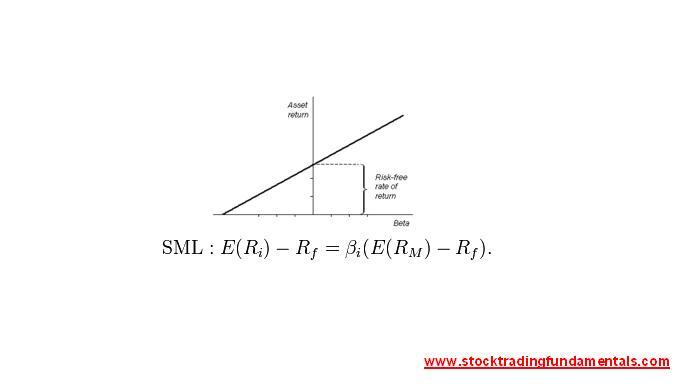

Risk and significance Of BETA (β)

Future Value (FVn) , Present Value (PVn) Of Investment

Copyright 2011 Stock Trading Fundamentals. All rights reserved.

Swayam Academy , 403-C , Fourth Floor , Richmond Plaza

Richmond Circle , Opp To Employee Provident Fund Office

Bengaluru, Karnataka 560 028

India

ph: 08041212385

feedback